This company, along with the big reinsurance corporations that handle the majority of global risks undertaken by companies, cities and countries, is educating its clients and investors about the increasing vulnerability of physical assets and human welfare to the volatility of climate change events. The largest companies, Munich Re, Swiss Re, Berkshire Hathaway/Gen Re Group, Hannover Re Group, and Lloyd's of London are all addressing this progression in risk exposure in their public and private communications. Munich Re, for example, lays out the possible dynamics of the upcoming El Nino oscillation this year.

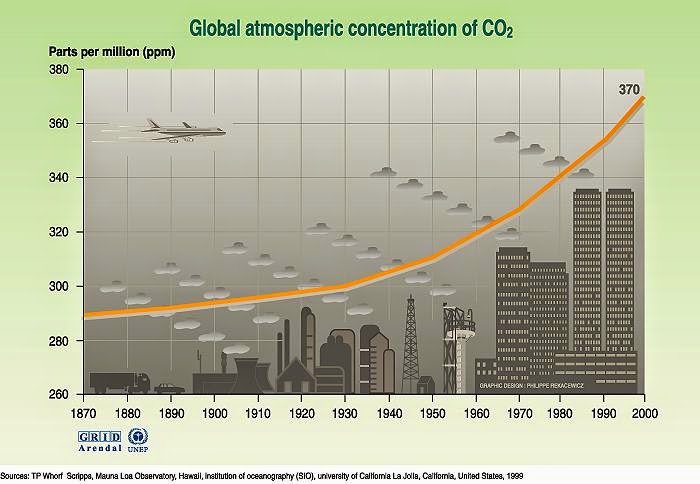

The oscillation in and of itself isn't unusual, but the increasing average surface temperature is, which creates more disruptive events in the weather. These factors are becoming more critical in human habitation, and so the entire building and planning industry is affected, requiring more resiliency in architectural design, urban planning and industrial systems. As NOAA has documented, the entire planet is rapidly becoming warmer. This drastically impacts food and water supplies for an overburdened planet.

This issue is more comprehensively covered in Mark Schapiro's LAT Op-Ed piece, "The Carbon Taxes We're Already Paying", and reviews the risks and damages that have been accumulating over the last decade or more because of externalized costs being borne by the public. He points to the $2.5 trillion annual environmental costs which are not accounted for in corporate profit and loss statements.

We're facing an unprecedented problem that the world must decisively deal with very soon, and fortunately other global players besides the oil hegemony are now coming into the mix. The twentieth century should not be allowed to make a wasteland out of the 21st.